wealthfront vs betterment tax loss harvesting

Thanks to its stock-level tax harvesting strategy investors can get an edge over. Wealthfront stands out in the robo-advising world because they offer daily tax-loss harvesting on accounts.

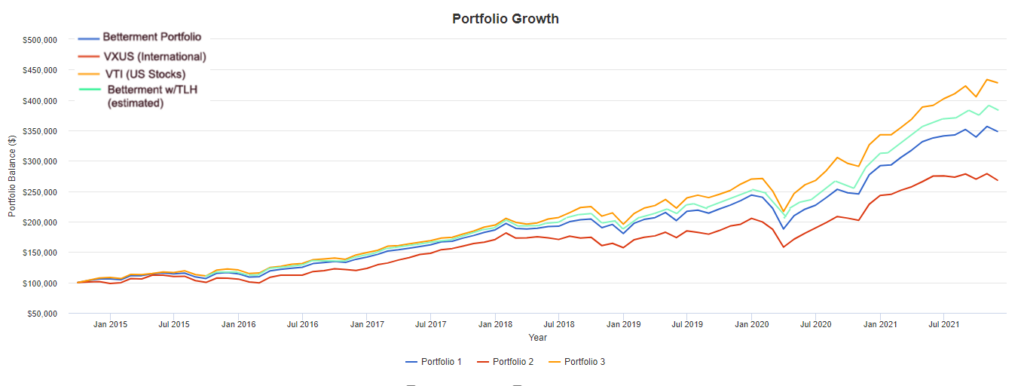

Calculating The True Benefits Of Tax Loss Harvesting Tlh

That may be chump change when you first start out but as your balance grows so will the gains realized by tax loss harvesting.

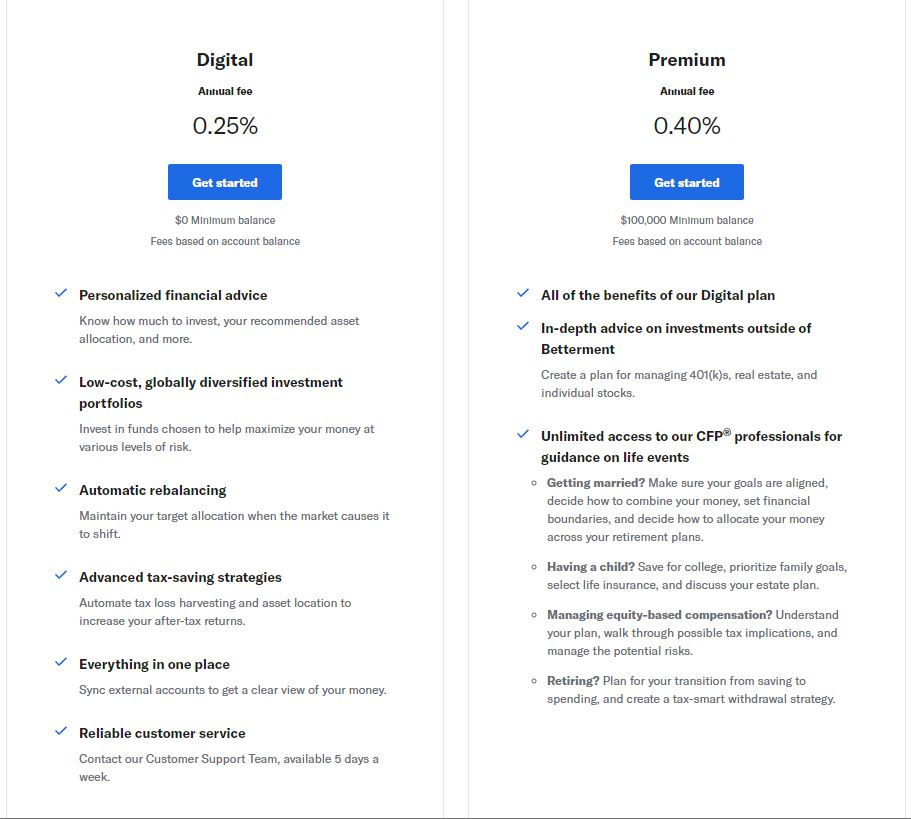

. Betterment and Wealthfront both charge 025 for digital portfolio management. Tax-loss harvesting increases your return but it doesnt remove your tax liability. In either case that.

In addition tax loss harvesting strategies may produce losses which may not be offset by sufficient gains in the account and may be limited to a 3000 deduction against income. Tax-Loss Harvesting is a strategy that takes advantage of movements in the markets to capture investment losses which can reduce your tax bill leaving more money to invest. However the first 5000 is managed for free through the current promotion.

Retirement Planning and Cash Accounts with both services are very similar. Their methods for tax harvesting are similar involving selling assets that have generated losses and then buying related ones of similar exposure to replace them. If you have over 500k in Wealthfront they also offer stock level Tax-Loss harvesting which can increase harvesting opportunities.

Betterment provides tax loss harvesting at the index fund level but Wealthfront delivers more for those with more than 500K invested. If you have a portfolio of 100000 or more Wealthfront is the strongest offering by far. Its also a significant differentiator in the Betterment vs.

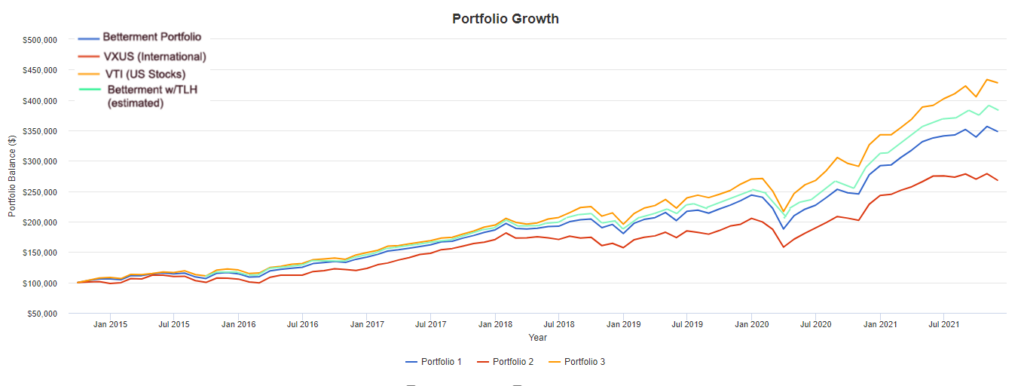

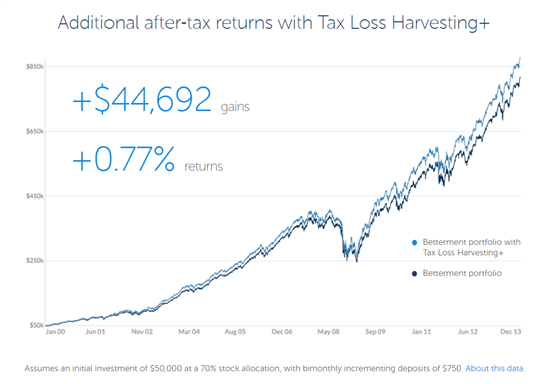

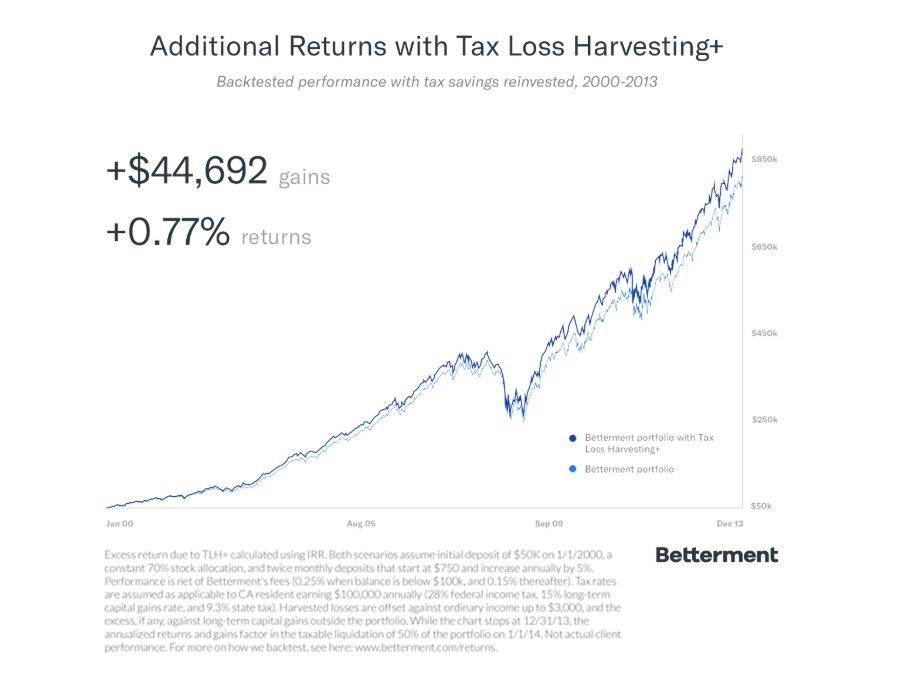

The utilization of losses harvested through the strategy will depend upon the recognition of capital gains in the same or a future tax period and in addition may be subject to limitations under. Betterment estimates that youll see a 077 increase in returns by using tax loss harvesting. Wealthfront also offers tax-loss harvesting.

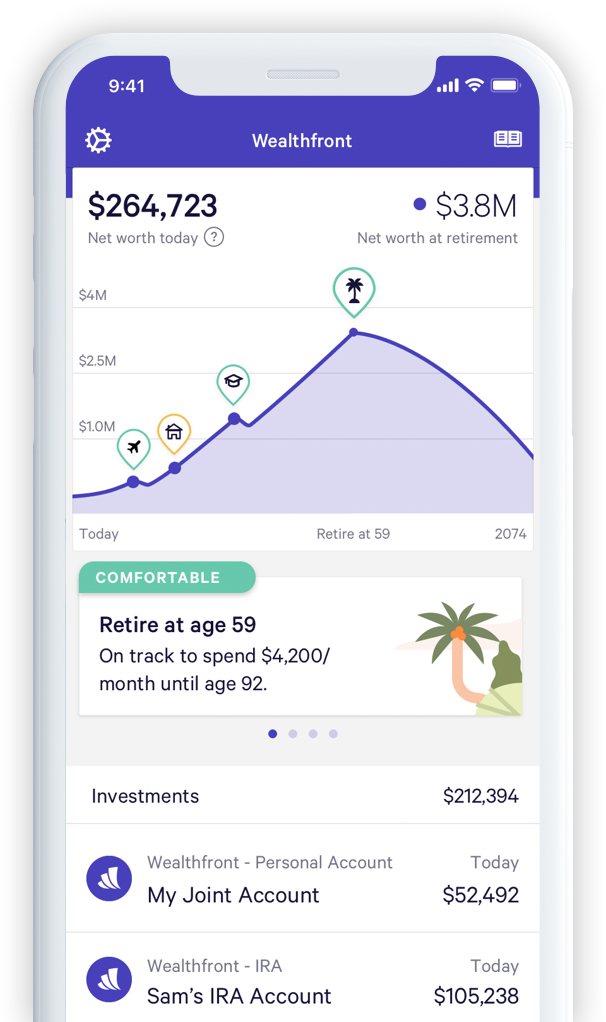

At a modest fee of 025 percent Wealthfronts portfolio management is combined with powerful goal-setting and financial planning tools like Path and Self Driving Money. Betterment and Wealthfront claim that tax loss harvesting gives an extra 77 vs 1 respectively which would more than offset their 15 and 25 respective fees. Because traditional advisers have to perform tax loss harvesting manually its usually reserved for accounts with high balances.

Investment Options For Betterment Vs Wealthfront. Regarding Tax Efficiency both offer access to advanced Tax-Loss Harvesting. Wealthfronts ability to customize down to the ETF level is unnecessary for many investors who appreciate the ease and optimization of robo-advised portfolios.

Betterments research claims that its tax loss harvesting on average improves your return by 077. Betterments Investment Portfolios Beat Wealthfront. Retirement Planning comes down to preference while Betterments Cash Account.

If this is true then these services pay for themselves and I might as well take advantage of. Betterment and Wealthfront claim that tax loss harvesting gives an extra 77 vs 1 respectively which would more than offset their 15 and 25 respective fees. But maybe most importantly both companies focus on low-cost ETFs for investment options.

Betterment VS Wealthfront Where Wealthfront Wins. These estimates are likely twice too optimistic and unreliable from year to year. Betterment charges 025 percent of assets annually for its entry-level service compared to Wealthfronts 025 percent.

Many robo-advisors dont offer tax-loss harvesting at all or offer it only if you meet a specific investment minimum. The service offsets taxable. Betterment and Wealthfront also take advantage of tax-loss harvesting which is a modern financial technique that involves buying and selling assets in a way that minimizes your tax bill.

Wealthfront offers one plan with a 025 annual advisory fee on all balance levels. But Wealthfront also offers digital financial planning tools while Betterment offers access to financial advisors for. Tax-loss harvesting is appropriate for taxable not retirement accounts.

Both companies offer significant tax strategy programs or tax-loss harvesting to every investor. It has an annual advisory fee of 040 but offers unlimited access to financial planners as well as in-depth advice on investments held outside Betterment. Wealthfront estimates that its stock-level tax loss harvesting can strengthen your returns by 161 with a margin of error of 344.

Wealthfront Tax-Loss Harvesting. Wealthfronts strength is its totally digital experience which includes portfolio customization tools and tax-loss harvesting on a daily basis. In fact Tax-Loss Harvesting typically generates savings worth at least 3x our advisory fee.

Both Wealthfront and SigFig offer tax-loss harvesting which is a common feature among most robo-advisors. Wealthfront does have a distinct advantage over Betterment because it offers the PassivePlus option for those who qualify. Wealthfront may have a slight edge here though as they offer daily tax-loss harvesting.

These are some of. However because Wealthfront offers stock-level tax-loss harvesting the company claims the strategy can help increase annual investment returns by up. Instead of individual stocks Betterment only does tax-loss harvesting for ETFs.

Both Betterment and Wealthfront enable tax-advantaged investing through tax-loss harvesting. Here again the two digital investment. Most investors would benefit more from being able to choose among Betterments nine portfolio strategies customizing.

Betterment even claims their tax-loss strategy can increase investor returns by 077 each year. Because Betterment builds in tax-loss harvesting any investor can take advantage of opportunities formerly reserved for the wealthiest investors. They claim this generates more savings over other robo-advisors who do less frequent checks.

Wealthfront Vs Betterment Best Robo Advisors Youtube

Wealthfront Vs Betterment Which Robo Advisor Is Best One Shot Finance

Betterment Tax Loss Harvesting Review What You Should Know About The Betterment Tax Program Advisoryhq

Wealthfront Vs Betterment Which Robo Advisor Is Best One Shot Finance

Wealthfront Vs Betterment Which Robo Advisor Is Best One Shot Finance

Betterment Vs Acorns Which Robo Advisor Is Best

Betterment Vs Wealthfront The Simple Dollar

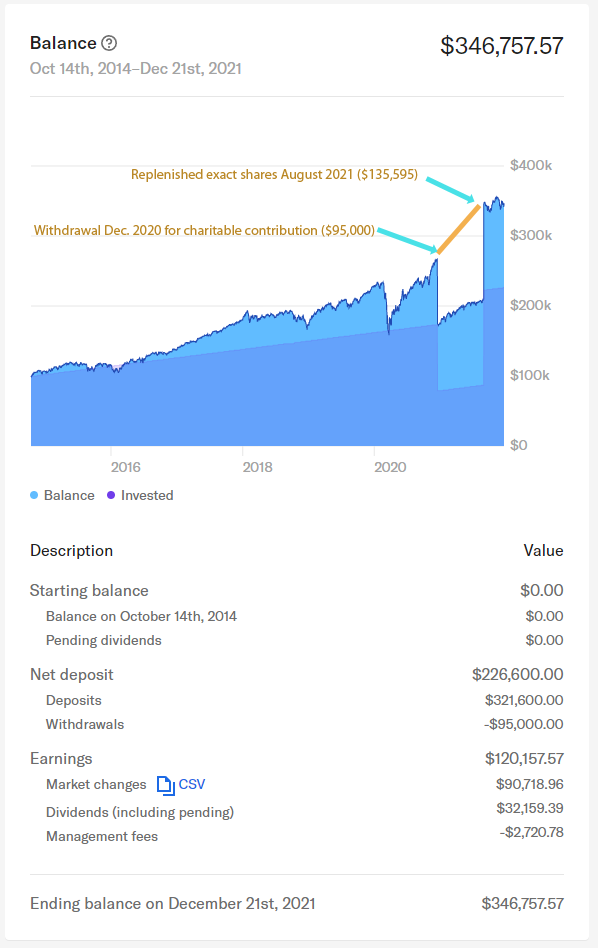

The Betterment Experiment Results Mr Money Mustache

Wealthfront Vs Betterment Wealthfront

Betterment Tax Loss Harvesting Review What You Should Know About The Betterment Tax Program Advisoryhq

The Betterment Experiment Results Mr Money Mustache

Wealthfront Vs Betterment Which Robo Advisor Is Best One Shot Finance

Wealthfront Vs Betterment Which Robo Advisor Is Best One Shot Finance

Betterment Returns Can You Really Make Money

Betterment Vs Wealthfront Which Robo Advisor Is Best For You

The 13 Best Robo Advisors For 2022 Pros Cons Top Picks Investinganswers

Which Is Better For Investing Betterment Vs Wealthfront Gobankingrates

Wealthfront Vs Betterment Which Robo Advisor Is Best One Shot Finance

Betterment Tax Loss Harvesting Review What You Should Know About The Betterment Tax Program Advisoryhq